Ο πρόεδρος εταιρείας συμβούλων που αναδιάρθρωσε το Ελληνικό χρέος, καλεί την ΕΕ να πετάξει την Ελλάδα έξω από το Ευρώ!!

Ο πρόεδρος εταιρείας συμβούλων που αναδιάρθρωσε το Ελληνικό χρέος, καλεί την ΕΕ να πετάξει την Ελλάδα έξω από το Ευρώ!!Θυμάστε τις εταιρείες που ανέλαβαν την αναδιάρθρωση του Ελληνικού χρέους; Που τότε μας το παρουσίαζαν ως “σωτηρία” αλλά αποδείχτηκε καταστροφή για τα Ελληνικά ταμεία, τα ΝΠΔΔ, τους μικροομολογιούχους κλπ;

Πάρτε τώρα την είδηση για να δείτε...

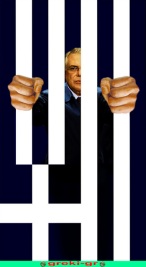

ποιούς κάλεσαν για να σώσουν την Ελλάδα. Ο πρόεδρος της Blackstone που βοήθησε στην καταστροφή, αλλά παρουσιάστηκε και πληρώθηκε ως μεσσίας, καλεί την Ευρωζώνη να πετάξει την Ελλάδα έξω από το Ευρώ για να σωθεί.

Όταν πληρωνόταν για να κάνει την αναδιάρθρωση, δεν το ήξερε; Ή μήπως η αναδιάρθρωση έγινε ακριβώς για να μπορέσουν ευκολότερα να πετάξουν την Ελλάδα έξω από το Ευρώ αφού πρώτα είχαν ξεπουλήσει τα “τοξικά” ομόλογα στα Ελληνικά ταμεία;

ΚΑΠΟΙΟΣ ΕΙΣΑΓΓΕΛΕΑΣ;

Blackstone president: Oust Greece from euro

By Greg Roumeliotis

NEW YORK (Reuters) – Blackstone Group LP President Tony James, whose investment firm advised Greece’s lenders on a 206 billion euro debt restructuring, said on Thursday that the euro zone will have to expel Greece and Portugal in order to survive.

Debt-laden Greece, whose private creditors were advised by Blackstone on a haircut on their bond holdings last March, is now trying to convince its European peers, including paymaster Germany, that it needs more time to bring its finances on track.

“They will keep Greece in the euro for a while longer but eventually I think they will have to push Greece and Portugal out of the euro and protect the core of the euro some way,” James told a market conference in New York on Thursday.

“That will mean that Germany has to pony up and it means that other countries will have to subjugate their budget to the will of the European Union,” James said.

Euro zone officials were working on urgent measures on Thursday to ease financial market pressure on Spain and Italy, which are too big to bail out, as EU leaders began a summit deeply divided over how to resolve their debt crisis.

Many international investors have deserted Spanish and Italian debt, pushing yields to levels that Madrid at least cannot afford for long as it tries to save banks ravaged by a property market collapse and rein in an overshooting deficit.

“The crisis in Spain or Italy pushes them to the actual solution because they are too big to hide. How long (until there is a solution)? I don’t know, we are getting close,” James said.

Saving the euro requires fundamental changes which are challenging to implement because they need backing from 17 euro zone member countries, James said.

“There is political will to keep (the euro) together, clearly. I don’t think anyone wants to face the crisis today. I think they will continue to try to substitute liquidity for structural solutions,” James said.

(Reporting by Greg Roumeliotis in New York; Editing by Richard Chang)

www.reuters.com/article/2012/06/28/us-blackstone-euro-idUSBRE85R1MQ20120628

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου